Explanatory Notes on Main Statistical Indicators

Employment refers to total number of persons engaged in social economic activities that generate income, including:

(1) Total formal employees

(2) Reemployed retirees

(3) Employers in urban private enterprises

(4) Urban individual laborers

(5) Employment in urban private enterprises and individual households

(6) Employment in township and village enterprises

(7) Rural laborers

(8) Other social laborersúĘServicemen includedúę

Staff and Workers refers to those who work in (and receive income there from) units with state ownership, urban collective ownership, joint ownership, share holding stock ownership, limited liability corporations, foreign and Hong Kong, Macao, and Taiwan Chinese fund or other ownership and their affiliated units.

On-post Staff and Workers refer to those who are practically working in a certain urban unit, including those who are temporarily absent because of study, disease, vocation or other reasons.

Year-end Number refers to those who are employed on the last day of the year.

State-owned Units refers to various enterprises, institutions, and government administrative organizations at various levels, social organizations, etc., with state ownership of production means.

Collective-owned Units refers to various enterprises and institution with collective ownership of production means, including various rural economic organizations engaging in agriculture, forestry, animal husbandry and fishery, enterprises and institutions run by townships and villages; collective enterprises and institutions run by cities, counties, towns, and neighborhood committees.

Other Ownership Units involve joint ownership, share holding stock ownership, limited liability corporations, foreign and Hong Kong, Macao, and Taiwan Chinese fund or other ownership.

Employment in Urban Private Enterprises and Individual units refers to those who have their population records in urban area and take part in productions or operations in urban private enterprises or individual units, and get earnings from the units, including helpers, apprentices and employees.

Primary Industry refers to farming, forestry, animal husbandry and fishery.

Secondary Industry refers to mining manufacturing, electricity, production and supply of electriciy, heat, gas and water and construction.

Tertiary Industry refers to the sectors except primary industry and secondary industry.

Enterprises refer to those units engaged in economic activities such as production, circulation, operation or service, etc.

Institutions refer to those units engaged in service activities for production and daily life, such as transportation, real estate, public affairs, health care, sports, education, social welfare, communication, science research, etc.

Organizations refer to those units engaged in organizing and coordinating activities on society, politics, economics and science, such as government and Party agencies, communities, social and personal services, etc.

Total wages refer to total remuneration payment to all employment in various units in urban area (excluded urban private sectors and individuals) during a certain period of time, including staff and workers and other employment (i.e., reemployed retirees or those who are from Hong Kong, Macao, Taiwan or other countries).

Total Wage Bill of employees refers to total remuneration payment to all employees in various units in urban area (excluded urban private sectors and individuals) during a certain period of time. The calculation of total wage bill is based on the total remuneration payment. Therefore, wages and salaries and other payments to employees should be included at all and regardless of its resource, category, both in kind or cash.

Average Wage of employees refers to the average wage level in money terms per employee during a certain period of time, it is calculated as follows:

![]()

Average Real Wage of employees refers to the average wage of employees after deducting consumer price index, which is calculated as follows:

![]()

Urban Unemployment refers to those urban inhabitants who (1) aged 16 or above, (2)be able to but not work, (3)meanwhile looking for a job, and (4)available for work within two weeks.

Urban Registered Unemployment refers to those who (1) with nonagricultural residence cards, (2) within a certain working age scope (16 to retired age), (3)be able to but not work, (4)want to work and have registered in the local labor exchanges for looking for jobs.

Urban Unemployment Rate refers to the ratio of unemployment in urban area to total employment and unemployment in urban area, which is calculated as follows:

![]()

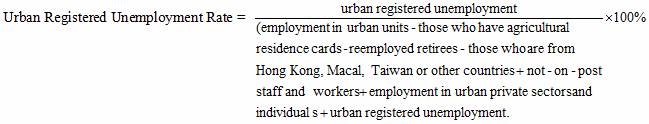

Urban Registered Unemployment Rate refers to the ratio of urban registered unemployment to the sum of employment in urban units (excluded those who have agricultural residence cards, reemployed retirees, and those who are from Hong Kong, Macao, Taiwan or other countries) and not-on-post staff and workers and employment in urban private sectors and individuals and urban registered unemployment. It is calculated as follows:

Basic Pension Insurance

1. Number of staff and workers covered refer to staff and workers participating in the basic pension insurance programme according to national laws, regulations and related policies at the end of the reference period, who have already had payment records in social security management agencies, including those who have interrupt payment without terminating the insurance programme. Those who have registered in the programme but with no payment records are not included.

2. Number of retirees participating in the basic pension insurance programme refer to the number of retirees participating in basic pension insurance programmes by the end of the reference period.

3. Revenue of the basic pension insurance programme refers to payments made by employers and individuals participating in the pension insurance programme in accordance with the basis and proportion stipulated in State regulations, and income from other sources that become source of pension insurance fund, including the premium paid by employers and staff and workers, interest income, subsidies from higher level agencies, income as transfer from subordinate agencies, transferred income, government financial subsidies and other income.

4. Expenditure of basic pension insurance programme refer to payment made on pensions and funeral subsidies to those retired and resigned people covered in pension insurance programmes according to related national policies on scope and standard of expenditure. Also included are expenditure which arises due to shift of the insurance relationship or adjustment of funds among agencies. More specifically, included are pensions for resigned people, pensions for retired people, pension for people quitting jobs, various subsidies, medical fees, funeral subsidies, compensation payments, management fees for social security agencies, expenses on subsidies to lower subordinates, expenses as transfer to agencies at higher level, transferred expenditure and other expenditure.

5. Balance of basic pension insurance programme refers to the balance of basic pension insurance funds at the end of the reference period after deducting expenses from revenue.

Basic Medical Care Insurance

1. Number of people participating in the insurance programme refers to people participating in the basic medical care insurance programme according to related regulations as at the end of reference period.

2. Revenue of the insurance programme refers to payments made by employers and individuals participating in the medical care insurance programme in accordance with the basis and proportion stipulated in State regulations, and income from other sources that become source of medical insurance fund, including income paid by units, individual paid income, financial assistanceí»s income (including individual income from medicaid), financial subsidiesí» income, interest income and other income.

3. Expenditure of the insurance programme refers to payment made to people covered in basic medical care insurance programme within the scope and standards of expenditure according to related national policies, and medical care payment and other expenses, including medical expenses of hospital inpatients, medical expenses for outpatients and emergency patients, payment from individual accounts and other expenditure.

4. Balance of the basic medical care insurance programme refers to the balance of medical care insurance funds at the end of the reference period.

Unemployment Insurance

1. Number of people covered refers to staff and workers in urban enterprises or institutions who have participated in the unemployment insurance programme according to relevant policies and regulations, and other people who have participated according to local government regulations, as at the end of reference period.

2. Revenue of the unemployment insurance programme refers to the total unemployment insurance funds raised in the reference period, including unemployment insurance premium, interest income, financial subsidies, other income, transferred income, subsidies from higher level agencies and income as transfer from subordinate agencies..

3. Expenditure of the unemployment insurance programme refers to total expenses during the reference period to guarantee the basic livelihood of unemployed people, and to encourage their re-employment. Included are unemployment relief, medical fees, funeral subsidies, compensation payments, training expenses, management fees for unemployment insurance agencies, subsidies to lower level agencies, expenses as transfer to higher level agencies, transferred expenditure and other expenditure.

4. Balance of the unemployment insurance programme refers to the balance of revenue of the programme after deducting expenses at the end of the reference period.

Work Injury Insurance

1. Number of people covered refers to staff and workers who have participated in the work injury insurance programme and number of employees in private business according to relevant national regulations at the end of the reference period.

2. Number of beneficiaries refers to number of people benefited from work injury insurance, as a result of work injury or occupational disease. It is the sum of beneficiaries from the work injury medical treatment withut rating, disabilities and deaths at work places.

3. Revenue of the work injury insurance programme refers to payments made by employers participating in the work injury insurance programme in accordance with the basis and proportion stipulated in State regulations, and income from other sources that become source of work injury insurance fund, including income of social comprehensive funds paid by employers, government financial subsidies, interest income and other income.

4. Expenditure of the work injury insurance programme refers to payments made from work injury insurance funds to those who participated in the work injury insurance programme and their direct dependents within the scope and standards of expenditure according to related national policies, and other expenditure, including medical fees for work injury, injury and disability subsidies, death subsidies, nursing fees, funeral subsidies, injury prevention fees, occupational rehabilitation fees and other expenditure.

5. Balance of the work injury insurance programme refers to the balance of the work injury funds at the end of the reference period.

Maternity Insurance

1. Number of people covered refers to people who have participated in the maternity insurance programme according to relevant regulation at the end of the reporting period.

2. Revenue of maternity insurance refers to payments made by employers participating in the maternity insurance programme in accordance with the basis and proportion stipulated in State regulations, and income from other sources that become source of maternity insurance fund, including income of funds paid by employers, interest income and other income.

3. Expenditure of the maternity insurance programme refers to payments made from maternity insurance funds to staff and workers who participate in the maternity insurance programme within the scope and standards of expenditure in accordance with related national policies, expenses paid for pregnancy, child delivery or surgeries related to family planning, and other expenditure, including allowance for child bearing, medical fees and other expenditure.

4. Balance of the maternity programme refers to the balance of the maternity insurance funds at the end of reference period.